Citigroup (NYSE:C) is a global bank that specializes in serving multinational corporations and U.S. consumers. It dates back more than 200 years to 1812. I’ve been buying C shares since 2022, and I’m sitting on a 40% gain. I remain bullish on Citigroup because the valuation sits at just 8x my estimate of normalized earnings. Also, Citi is becoming more like JPMorgan Chase (NYSE:JPM) in terms of its business model, capital requirements, and balance sheet.

Citi Is a Financial Fortress

Citigroup has been the dog of the U.S. banking industry for some time now. Going into the 2008 financial crisis, the bank had huge exposure to mortgage-backed securities and a highly leveraged balance sheet. This caused liquidity issues, resulting in capital raises and a collapse in Citi’s stock. But Citi is in a completely different position now.

If we fast forward to today, Citigroup’s balance sheet looks like a financial fortress, on par with JPMorgan Chase. I like to look at a bank’s CET1 ratio (a bank’s core equity capital relative to its risk-weighted assets), its leverage (assets to equity), and its liquidity (loans to deposits). Here are some of the numbers for Citigroup: CET1 ratio ~13.5%, assets to equity ~11.72x, loans to deposits ~0.50x. This compares favorably to JPMorgan Chase: CET1 ratio ~15.0%, assets to equity ~12.15x, loans to deposits ~0.55x.

Citi beats JPMorgan Chase on two of the three metrics. A higher CET1 ratio is better, signaling capital adequacy. Also, a lower assets/equity and loans/deposits ratio is better, signaling financial resilience and ample liquidity. Both of these banks are world leaders in terms of the strength of their balance sheets and compare favorably to U.S. peers. This is largely thanks to Dodd-Frank regulations, which were designed to prevent a recurrence of the global financial crisis.

Why Citi Could Perform Well

So, why has Citi underperformed JPMorgan Chase by such a wide margin? In short, Citi has suffered because of its international exposure. Regulators have disliked Citi’s complex, global business for years and have saddled the company with regulatory hurdles. This forced Citigroup to hold more capital than its competitors, resulting in lower returns on equity. The U.S. economy has also outperformed the rest of the world over the past decade. But, this could reverse, and Citi’s CEO has a plan for change.

Citi has been selling its international retail banks, simplifying its business, and improving its risk controls. Citi’s transformation plan is designed to reduce its capital requirement over time while maintaining its competitive advantages. In other words, Citi’s business model should become more consistent with that of JPMorgan Chase.

JPMorgan Chase’s CET1 capital requirement is just 11.4% compared to Citi’s CET1 capital requirement of 12.3%. If Citi can decrease the amount of capital it needs to hold, the bank should be able to return its excess cash to shareholders. This is a major tailwind that other U.S. banks just don’t have. But at Citi, this could result in an eventual buyback windfall, sending EPS and the stock higher.

Citi’s Business Is Underrated and Has a Moat

Veteran bank analyst Mike Mayo, who has Citi as his top bank stock in 2024, shared some encouraging words on the strength of Citi’s core businesses. In an interview on CNBC, he addressed concerns about Citi’s Wealth Management business, saying the following:

“I concede Wealth, that’s 10% of the company. I don’t know where that’s going to go. They say that’s going to improve. They have Andy Sieg, great. But, 80% of the company is very well positioned at Citigroup. You have the global payments or services business ~ best-in-class, 25% of the company. Markets and banking, as you know, top five global investment bank. And, a top three credit card player. That’s 80% of the company.”

Mike Mayo, Wells Fargo

Notice that Mike said Citi’s global payments/services business is “best-in-class.” But why? Well, Citi operates across almost 160 countries and moves $4 trillion every single day. Citi has an extensive on-the-ground footprint, which involves connections with local regulators and central banks across the globe. This, along with Citi’s interconnectedness and technological prowess, gives it a competitive advantage (A.K.A. a moat). It took enormous amounts of capital and decades to build this position.

Calculating Citi’s Normalized Earnings

I believe Citi is substantially under-earning. Recently, Citi’s earnings have been hammered by temporary expenses and impairments. During Citi’s Q4 2023 earnings call, CFO Mark Mason said, “And on a full year basis, we delivered $9.2 billion of net income and an RoTCE of 4.9%, adjusting for the notable items, net income was approximately $13.1 billion with an RoTCE of 7.3%.”

Citi plans to increase its “RoTCE” or return on tangible common equity to 11-12% by 2026. On Citi’s current tangible common equity of $165 billion, this would equate to $18.2-19.8 billion, and that’s assuming Citi’s book value doesn’t grow (it likely will).

Moreover, if we apply Citi’s 10-year average return on assets, 0.62%, to its total assets of $2,432 billion, we can see that Citi’s normalized earnings are around $15 billion. On the company’s current market cap, this estimate results in a normalized PE of 8x.

So, you can see why I think Citi is still cheap. The company also trades at a significant discount to its tangible book value, while its peers’ shares tend to trade at a premium.

Is C Stock a Buy, According to Analysts?

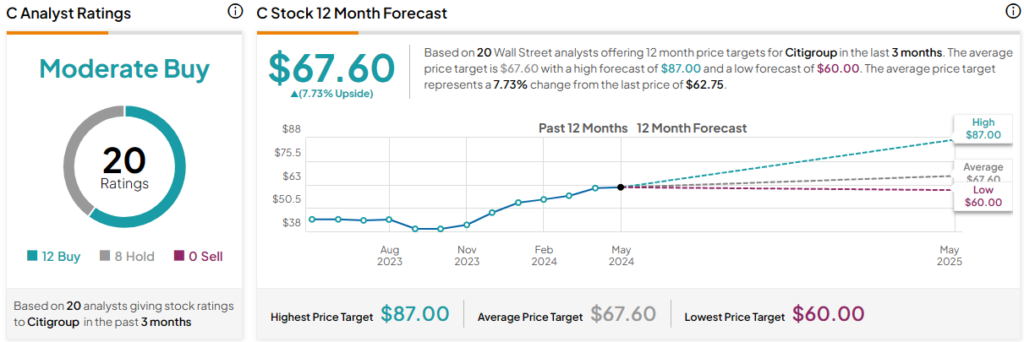

Currently, 12 out of 20 analysts covering C give it a Buy rating, resulting in a Moderate Buy consensus rating. The average Citigroup stock price target is $67.60, implying upside potential of 7.7%. Analyst price targets range from a low of $60.00 per share to a high of $87.00 per share.

The Bottom Line on C Stock

Citi is transforming, divesting its international retail banks, investing in its technology and controls, and simplifying its operations. This is making the bank more like JPMorgan Chase, which trades at a huge premium to Citi. Both companies have a fortress balance sheet, robust credit card business, top-notch global investment bank, and leading payments business. Now, Citi may soon have lower capital requirements as well, potentially improving its ROE and allowing it to shower shareholders with buybacks.