Shares of cannabis companies, like Canopy Growth (NASDAQ:CGC), have climbed upward. CGC stock has surged up over 120% in the past 90 days. And for a good reason.

The U.S Drug Enforcement Administration (DEA) recently announced that marijuana may soon be reclassified as a Schedule III drug, a significant shift away from its current designation as a Schedule I drug, where it has remained for several decades.

However, at the current price level, the upside growth potential looks priced in, suggesting investors may want to hold off and observe how events unfold and if Canopy can successfully ramp up its U.S. business before taking a position.

Canopy Growth’s Aggressive U.S Expansion

Canopy Growth Corporation is a Canadian-based cannabis company with diverse product offerings, including cannabis flower, vapes, edibles, and skincare products. The company has been taking strategic financial steps to strengthen its position in the U.S market, with shareholders recently approving an Exchangeable Shares Resolution, solidifying Canopy Growth’s plan to expand its footprint in the U.S.

As part of its expansion strategy, Canopy Growth instituted a U.S-based holding company, Canopy U.S.A, LLC, which then exercised its options to acquire two leading cannabis brands in Wana and Jetty: Wana, a known cannabis edibles brand in North America. Jetty is a California-based producer of high-end cannabis extracts and a leader in clean vape technology. These acquisitions are expected to facilitate revenue growth and cost synergies across the Canopy U.S.A ecosystem.

The company is projecting the U.S THC market could exceed $50 billion by 2026, with 85% of the total addressable market represented by states where Canopy currently has a presence.

Canopy Growth’s Recent Financial Results

For the most recent quarter, the company achieved consolidated gross margins of 36% for Q3 FY2024, vastly increasing from the previous year’s -11%. This significant growth is owed mainly to the surging gross margins in the Canadian cannabis sector, which climbed notably to 28%. Even after the divestiture of the Canada national retail business in Q3 FY2023, Q3 FY2024 net revenue posted a 6% growth year-over-year. However, the total consolidated net revenue at $79 million marked a slight decrease of 7% compared to the last year.

The rest-of-world cannabis revenue witnessed a remarkable 81% growth year-over-year in Q3 FY2024, primarily driven by robust growth in Australia, resurgence in Europe due to new product lines, and improved sales execution.

The company demonstrated a 57% improvement year-over-year in its free cash flow, closing Q3 FY2024 with a deficit of -$34 million. Overall debt was brought down by $69 million in Q3 FY2024, closing the year with a balance of $186 million in cash and short-term investments.

Further, Canopy signed an exchange and subscription agreement with an institutional investor. Through this agreement, the company expects to acquire gross proceeds of around $50 million while swapping approximately C$27.5 million of debt due in September 2025 for a new senior unsecured convertible debenture, maturing five years from the date of issuance.

Is CGC Stock a Buy?

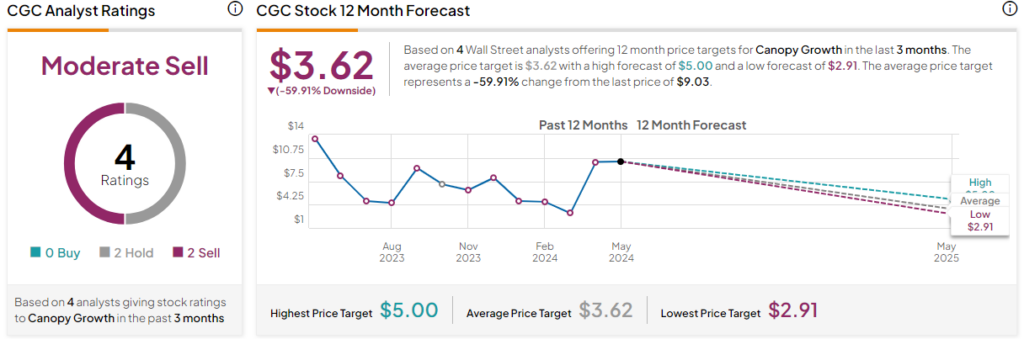

Canopy Growth is rated a Moderate Sell based on the ratings and 12-month price targets five Wall Street analysts assigned over the past three months. The average price target for CGC stock is $3.62, representing a -59.91% change from current levels.

The stock has been trending upward, climbing over 75% year-to-date. It trades in the middle of the 52-week price range of $2.75-$19.20. Currently, the stock appears relatively richly valued, with a P/S ratio of 2x, sitting well above the Healthcare sector average of 0.2x and the Specialty & Generic Drug Manufacturers’ industry average of 1.15x.

Final Analysis on CGC Stock

The potential opportunities of a rapidly shifting U.S cannabis landscape have stirred investors’ animal spirits, who have chased cannabis company stocks, driving prices up. Given its aggressive expansion strategy into the U.S market, Canopy Growth has been a popular speculative target. However, with the recent surge in stock price, the company’s growth potential appears to be priced in.

While Canopy Growth’s long-term prospects look promising, investors might want to hold off until the company demonstrates successful growth in earnings from U.S operations.