Online furniture and home furnishings provider Beyond (NYSE:BYON) reported a substantially widened net loss for the first quarter. Consequently, its shares are down by over 9% in the early trading session today.

Beyond’s brand portfolio includes Overstock, Bed Bath & Beyond, Zulily, as well as other online names. In Q1, the company’s top line remained largely unchanged at $382.3 million. However, its net loss per share widened to $1.22 from $0.10 a year ago. Moreover, the figure missed analysts’ expectations by a wide margin of $0.36.

Beyond’s Dismal Q1 Performance

Beyond has been focusing on building a strong brand portfolio and driving customer growth. During the quarter, its order deliveries increased by 27% to 2.2 million and the number of active customers increased by 26% to 6 million.

However, higher costs weighed on the company’s bottom line. Its cost of goods sold increased by nearly $28.4 million to $307.9 million, and total operating expenses shot up by around $21.8 million to $131.9 million. Consequently, the company’s operating loss widened to $57.5 million from $8.3 million a year ago. Additionally, a concern for investors is that while Beyond’s customer numbers are increasing, its average order value is declining (it stood at $173 in Q1 versus $220 a year ago).

Despite these hurdles, Marcus Lemonis, the Executive Chairman of Beyond, believes that the company’s three brands have the potential to reach a billion-dollar-plus size each. In recent times, Beyond has gravitated towards an asset-light model and cost reductions. Nevertheless, shares of the company are still down by nearly 73% over the past three years.

What Is the Stock Price Forecast for BYON?

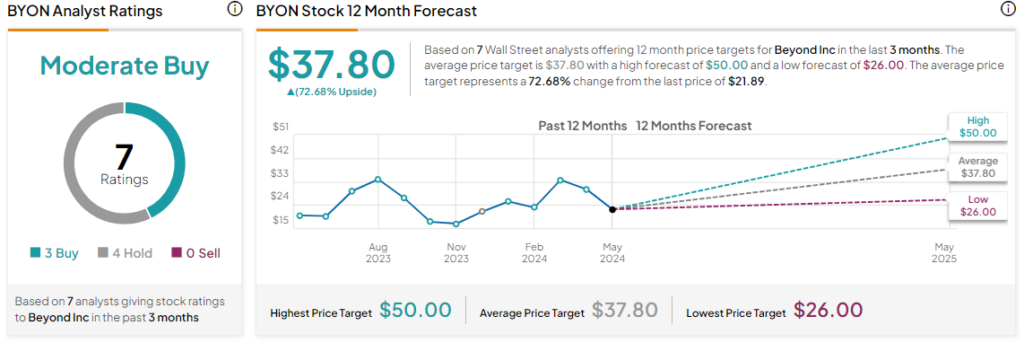

Overall, the Street has a Moderate Buy consensus rating on the stock, alongside an average BYON price target of $37.80. However, analysts’ views on the stock could see changes following its earnings report.

Read full Disclosure