Chip designer Arm Holdings (NASDAQ:ARM) had a lot going for it back during the chip shortage, but things aren’t looking quite so hot for it these days. Its earnings report had a lot to like, but that didn’t help matters much when the guidance came out. Arm shares slipped over 3% in Thursday afternoon’s trading as investors weren’t enthused by what the future looked like for the stock.

The earnings report numbers were certainly sound. Revenue was up 47% against this time last year, hitting $928 million. This was primarily led by the licensing business, which by itself tacked on 60% gains to hit $414 million, or almost half of Arm’s revenue by itself. However, the future was what hit Arm like a bus, as it revealed it was expecting revenue between $3.8 billion and $4.1 billion for its fiscal year 2025.

Given that analysts were looking for $3.99 billion, that’s within tolerances, but only just. There’s less chance for a beat here than there is a miss—there’s almost double the likelihood of a miss as there is a beat—and that’s got investors quite concerned.

A Dangerous Enemy

As if that weren’t bad enough, there are some troubling signs ahead for Arm. Recent reports suggest that Nvidia (NASDAQ:NVDA), flush with cash and investor interest, may take an interest in buying ARM out altogether. Its previous efforts on that front have failed, but Nvidia’s got a lot more to work with in the way of resources these days. It could be a big deal for Arm, or Arm might find itself on the bad end of competing with Nvidia, depending on how it all boils out.

Is ARM a Buy, Hold, or Sell?

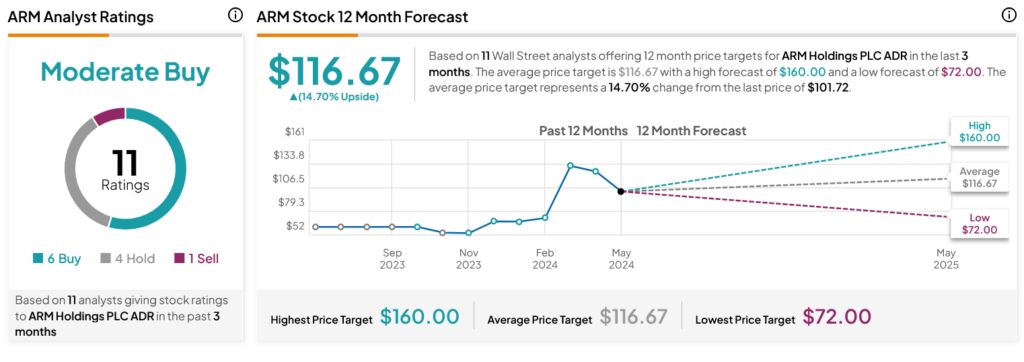

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ARM stock based on six Buys, four Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 69.07% rally in its share price over the past year, the average ARM price target of $116.67 per share implies 14.7% upside potential.