These are the 3 Best Travel Stocks to buy in May 2024, as per Wall Street analysts. The travel and tourism industry is booming in the post-pandemic era. Despite macro uncertainties, people are spending on both domestic and international travel, favorably impacting travel stocks. As the appetite for travel increases, the stock prices of airlines, hotels, ride-hailing companies, and cruise liners are expected to move higher.

With the potential expansion of the global tourism industry, we scanned for three stocks from different travel segments that analysts favor and have solid growth potential. Let’s dive right into them.

#1 Carnival Corp. (NYSE:CCL)

Florida-based Carnival Corp. is at the crux of the travel revival, witnessing robust demand for its cruise vacations. CCL operates a fleet of nearly 91 cruise ships throughout North America, Europe, Australia, and Asia via world-recognized brands, including Aida, Carnival, and Costa Cruises. In the past year, CCL stock has gained 37.6%.

In Q1 FY24, Carnival posted a narrower-than-expected adjusted loss of $0.14 per share, while revenue of $5.41 billion was in line with the Street’s estimates. CCL also raised its FY24 guidance citing higher ticket prices, a rise in onboard customer spending, and growing occupancy levels.

However, the cruise liner warned of a roughly $10 million hit to its Fiscal 2024 earnings from the recent collapse of a bridge in Baltimore. Moreover, CCL expects a $130 million cost (through November 2024) related to rerouting due to the Red Sea conflict. CCL is focused on reducing its debt and improving its financial leverage.

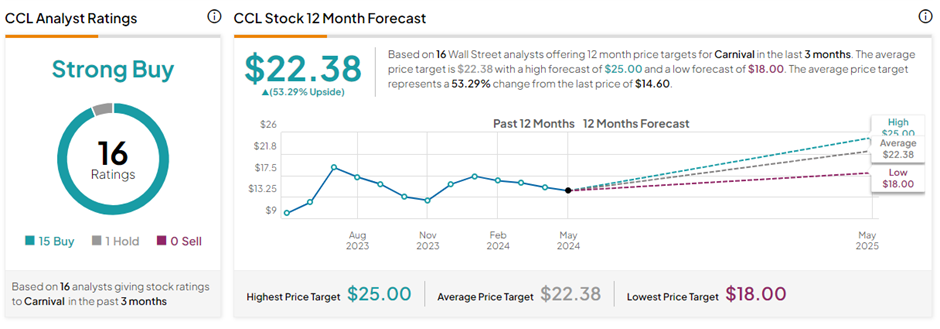

Is CCL a Good Stock to Buy?

With 15 Buys versus one Hold rating, CCL stock has a Strong Buy consensus rating on TipRanks. The average Carnival Corp price target of $22.38 implies 53.3% upside potential from current levels.

#2 Uber Technologies (NYSE:UBER)

Uber Technologies is a Transportation-as-a-Service (TaaS) provider. Apart from ride-hailing services, which Uber is known for, it also offers food and courier delivery services and freight transportation services globally. Its first-ever share buyback plan of $7 billion gives a major boost to its shareholders. In the past year, UBER shares have gained 84.2%.

Uber is slated to release its Q1 FY24 results on May 8, before the market opens. The Street expects Uber to post diluted earnings of $0.22 per share compared to a loss of $0.08 in the prior-year quarter. Meanwhile, the consensus for net sales is pegged at $10.10 billion, reflecting an increase of 14.5% compared to Q1 FY23. Importantly, Uber expects its gross bookings to be between $37.0 billion and $38.5 billion in Q1 FY24.

Uber is focused on cross-selling its services, which could reduce its customer acquisition costs, drive additional margin expansion, and increase its market share. The company’s ride-sharing services are gaining greater prominence with the back-to-office mandate worldwide, while its airport pick-up/drop services are picking momentum with higher air travel demand.

Is Uber a Buy or Sell?

On TipRanks, UBER stock has a Strong Buy consensus rating, backed by 35 Buys and one Hold rating. The average Uber Technologies price target of $89.44 implies 25.1% upside potential from current levels.

#3 Delta Air Lines (NYSE:DAL)

Delta Air Lines is among the oldest and four largest air carriers in the U.S. with global operations. It flies more than 190 million travelers to over 290 destinations across six continents, with up to 4,000 daily departures. DAL stock has surged 54.8% in the past year, driven by a healthy travel rebound and expectations of a return in its business to pre-pandemic levels.

For Q1 2024, Delta Air Lines exceeded both sales and earnings estimates. Operating revenue rose 8% year-over-year, supported by solid travel demand from corporate travel sales, improvement in domestic unit revenues, and strength in international travel. Meanwhile, a focus on operational excellence helped Delta to outpace the profit expectations. Delta even announced a quarterly dividend of $0.10 per share, reflecting a yield of 0.6%.

For Q2, Delta is experiencing normalizing growth and anticipates that non-fuel unit costs will increase by approximately 2%. Accordingly, the carrier expects to post record revenue (up 5%-7% year-over-year) in Q2 along with mid-teens operating margin and earnings between $2.20 and $2.50 per share.

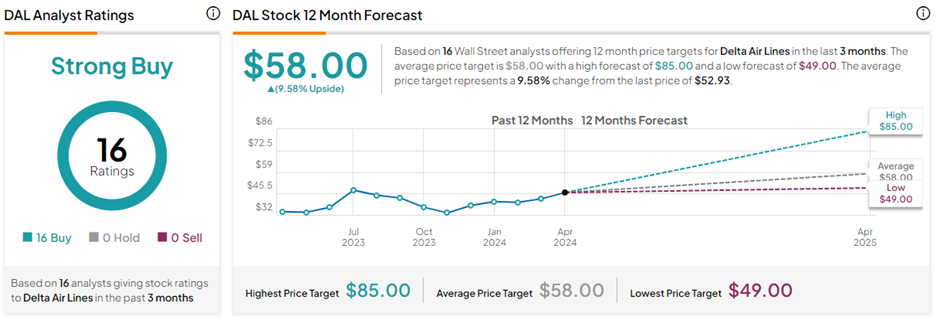

Is Delta a Buy or Sell?

With 16 unanimous Buy ratings, DAL stock commands a Strong Buy consensus rating on TipRanks. The average Delta Air Lines price target of $58 implies 9.6% upside potential upside from current levels.

Ending Thoughts

As per research by Statista, the global travel and tourism industry is expected to generate a market revenue of $1,063 billion by 2028, growing at a CAGR (compound annual growth rate) of 3.47%. Global travel demand has yet to reach the pre-pandemic levels, showing massive potential for growth in the coming years. Analysts are highly optimistic about the aforementioned three travel stocks and expect attractive share price appreciation in the next twelve months.