UK banking giant NatWest Group (GB:NWG) and retail company Kingfisher PLC (GB:KGF) have paid good dividends in the last year. In terms of capital growth, Kingfisher stock has a Hold rating from analysts, while NatWest carries a Moderate Buy rating. NWG stock also has more than 30% growth expected in its share price over the next 12 months.

TipRanks offers various tools, like the Dividend Calculator, Dividend Stocks, Stocks Comparison, etc., which make it easy for a user to screen and choose high dividend-paying companies.

Let’s dig deeper into some details.

Kingfisher PLC

Kingfisher is a UK-based retail company offering décor and home improvement products. The company owns brands like B&Q, Castorama, Screwfix, TradePoint, etc.

In March, the company announced its annual earnings for the fiscal year 2022-2023, which were in line with expectations. Total sales were almost similar to those of the previous year, but they exceeded the average industry numbers.

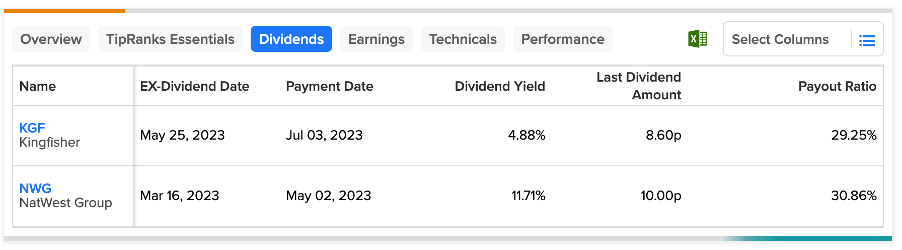

During the presentation of the results, the company announced a total dividend of 12.4p per share for 2022-2023. The dividends are similar to the previous year’s payments. This leads the company’s dividend yield to 4.7%, which is higher than the industry average of 2.12%. Even though the growth in the dividends is limited, they are stable and were smoothly covered by their earnings. This makes it an attractive pick in the long run.

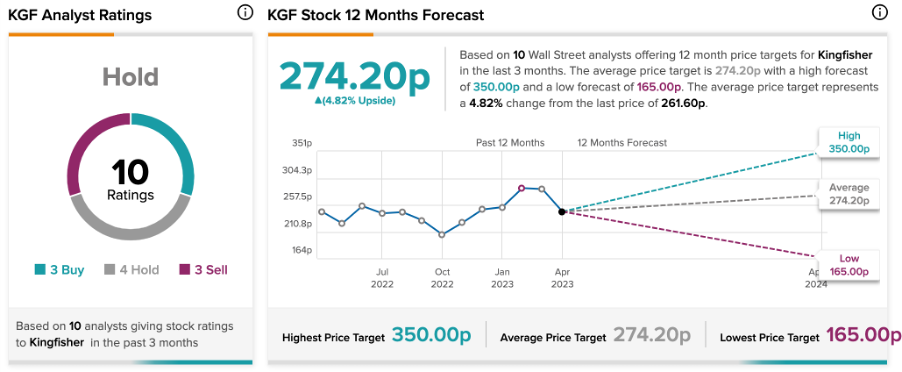

Kingfisher Share Price Forecast

KGF stock has a Hold consensus rating on TipRanks, based on four Hold, three Buy, and three Sell recommendations.

At an average price target of 274.2p, the stock has a small upside potential of 4.8% on the current trading levels.

NatWest Group

NatWest is among the top four largest banking groups in the UK. The bank has been a beneficiary of rising interest rates in the economy, which has pushed its share prices as well. In the last three years, the stock has soared and gained 187%.

UK banks have always been investors’ first choice for higher dividend income. NatWest has the highest dividend yield among the big four banks in the UK. The bank’s dividend yield is 11.71%, which makes it one of the best dividend-paying companies on the FTSE 100 index.

In 2022, the bank announced a special dividend of 16.8p per share in addition to the interim dividend of 3.5p per share. The final dividend for 2022 is 10p per share, which is payable in May 2023. The bank expects its total income to grow from £13.16 billion in 2022 to £14.8 billion in 2023. It also predicts a dividend payout of 40%.

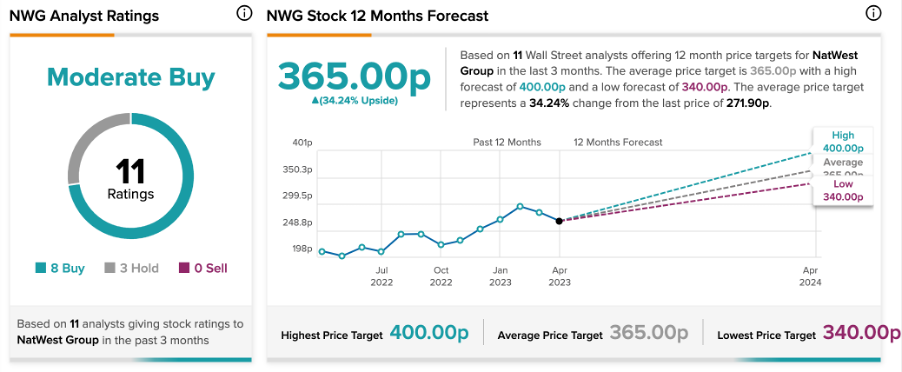

Is NatWest a Good Share to Buy?

According to TipRanks’ analyst consensus, NWG stock has a Moderate Buy rating. This is based on eight Buy vs. three Hold recommendations.

The average price prediction for the next 12 months is 365p, which implies an upside of 34.24% from the current level.

Conclusion

These companies from the UK could be the perfect addition for investors looking for a balance between consistent and growing dividend stocks in their portfolios.