The FTSE 100-listed National Grid PLC (GB:NG) offers an exciting opportunity to investors with a dividend yield of 5.39%. The company has also been consistent in distributing its dividends since 2005 and has gradually increased its payments in the last few years.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

National Grid is a British utility company engaged in the distribution of electricity and gas.

TipRanks provides a range of tools to assist users in discovering dividend stocks matching their preferences. For this analysis, we have used the TipRanks Top Dividend Shares tailored for the UK market. This tool consolidates a thorough list of high-dividend-paying companies, accompanied by several other parameters for users to evaluate.Let’s take a look at some details.

National Grid’s Dividend History

National Grid generally distributes dividends semi-annually, declared alongside the full and half-year results in May and November, respectively.

In the first-half results for FY23/24, the company announced an interim dividend of 19.4p per share, which was 9% higher on a year-over-year basis. This dividend will be paid on January 11, 2024.

Moving forward, the company expects its EPS to grow at a CAGR (compound annual growth rate) within the range of 6-8% until 2025/26 as part of its five-year financial framework. This projection supports its commitment to maintaining a sustainable and progressively growing dividend policy in the future.

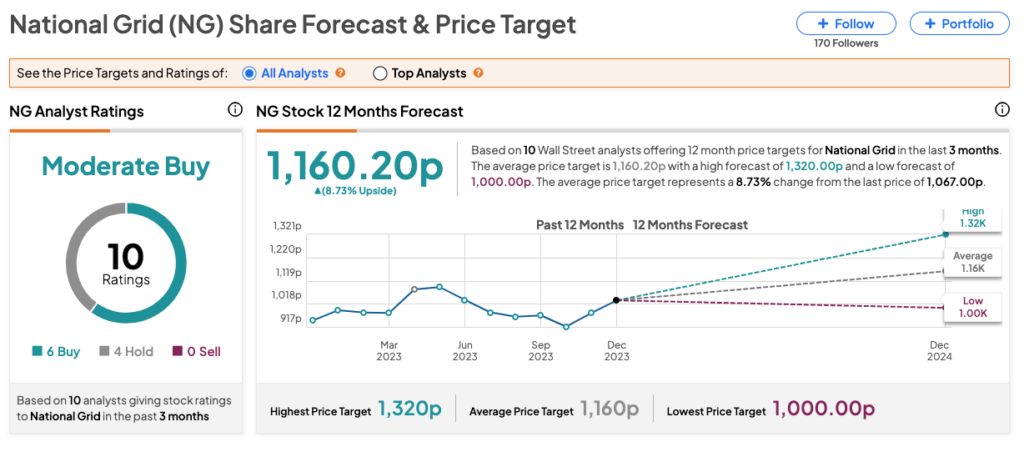

What is the Price Target of National Grid?

In terms of share price appreciation, analysts are cautiously bullish on the stock and predict a modest upside in the share price. In 2023, the stock gained over 3% in trading.

According to TipRanks’ consensus, NG stock has received a Moderate Buy rating based on six Buy and four Hold recommendations. The National Grid share price target is 1,160.20p, reflecting an increase of 8.7% from the current level.