Advanced Micro Devices (NASDAQ:AMD) has found itself trailing the pack this year, with its stock down 13% year-to-date. While rival chipmakers ride the AI boom to new heights, AMD has been left in the dust.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

For a company often touted as a serious challenger to Nvidia (NASDAQ:NVDA) in the AI chip game, this underperformance might come as a surprise.

But the market’s current stance suggests skepticism about AMD’s ability to pose a meaningful threat. Northland analyst Gus Richard, however, isn’t buying that narrative. He sees brighter days ahead for the Lisa Su-led firm.

“We expect CY25 to be a strong year for AMD as it continues to gain share in AI GPUs, server CPUs, PC clients, and headwinds from embedded and gaming abate. AMD is winning share in AI based on its roadmap and TCO (total cost of ownership),” said Richard, who ranks in the top 2% of Wall Street stock experts.

The 5-star analyst is calling for AI revenue of $9.5 billion in CY25, with the first half of CY25 showing a 7% increase vs. the second half of CY24. As AMD is set to ramp its MI325X accelerators in the first half of the year, Richard makes the case that this is a conservative estimate, believing the GPU stands up against Nvidia’s H200. Additionally, AMD appears to be pricing its product strategically to gain scale, with margins below the corporate average non-GAAP gross margin of 54%, compared to Nvidia’s estimated data GPU gross margin of 85%.

While AMD is eyeing Nvidia’s dominance in AI chips, for several years now, it has been eating away at Intel’s dominance in server and client CPUs, and here, Richard thinks AMD will “continue to take share” simply because its products are better.

The analyst also thinks that as Microsoft ends support for Windows 10 – which runs on an estimated 1.2 billion systems – the PC refresh cycle will “likely be much stronger than we have modelled.” Richard reckons that approximately 40% of these systems (or 480 million units), will be replaced over the next 18 months. For CY25, then, Richard is projecting client revenue of $7.9 billion, reflecting a 15% year-over-year increase. “We believe the client revenue could easily be $1B to $2B above our estimate of $7.9B if the replacement cycle unfolds as expected and AMD maintains market share,” the analyst went on to say.

Looking further ahead, there’s more good news as Richard also thinks that the ”trends that unfold in CY25 will persist into CY26.”

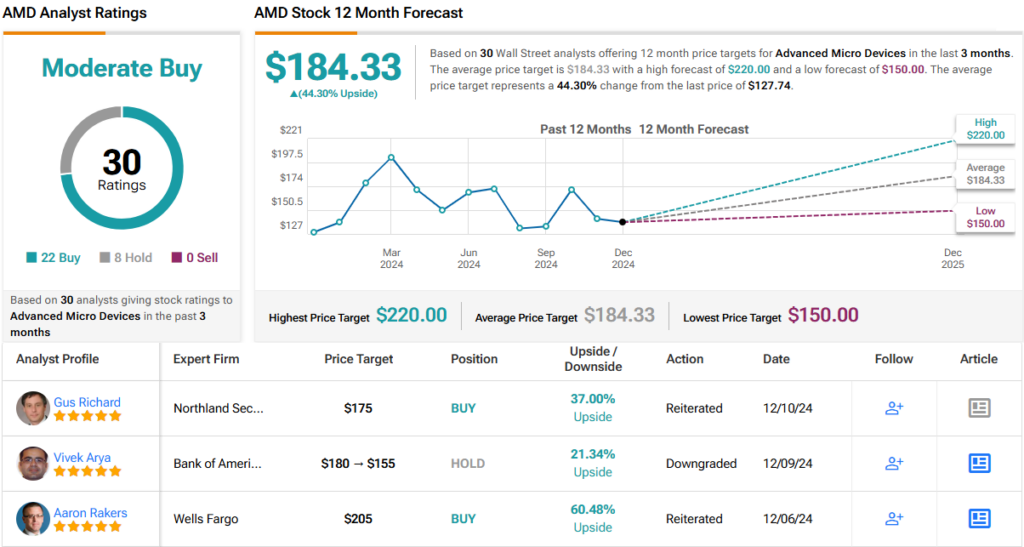

Given these bullish projections, Richard rates AMD shares an Outperform (i.e., Buy) and sets a $175 price target, implying a ~34% upside from current levels. (To watch Richard’s track record, click here)

The Street’s average price target is a little higher; at $184.33, the figure makes room for 12-month returns of 44%. On the rating front, based on a mix of 22 Buys vs. 8 Holds, the analyst consensus rates the stock a Moderate Buy. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.