Research shows that an overwhelming majority of consumers expect companies to be environmentally conscious. This has given rise to political and economic pressure on companies to adopt an eco-friendly approach to developing their products and services. Companies like Ingevity (NYSE:NGVT) are at the forefront of helping companies make a green transition. Growing revenues and earnings have helped drive the stock up over 15.6% year-to-date and make it an intriguing opportunity for ESG-oriented investors.

Sustainability-Focused Solutions

Ingevity develops and manufactures products and technologies designed to tackle complex customer issues and create a range of sustainable solutions. Its operations span 31 countries, and it employs about 1,700 people worldwide.

The company operates under three significant segments – Performance Materials, Advanced Polymer Technologies, and Performance Chemicals. Performance Materials encompass activated carbon, Advanced Polymer Technologies include caprolactone polymers, and Performance Chemicals comprise specialty chemicals and road technologies.

These products are used in numerous demanding sectors, such as adhesives, agrochemicals, asphalt paving, biodegradable bioplastics, coatings, elastomers, lubricants, pavement markings, oil exploration and production, and automotive components.

A Look at Ingevity’s Recent Financial Report

Ingevity’s first quarter results were solid. The company reported revenue that superseded expectations, hitting $340.1 million despite a 13.4% year-over-year drop, mainly due to the repositioning of Performance Chemicals and ongoing sales weakness in China. An overall net loss was reported at -$56 million with an adjusted EBITDA of $76.9 million. The operating cash flow was negative at -$12.1 million, and the free cash flow was negative at -$28.7 million due to normal seasonal inventory build-up and crude tail oil (CTO) resale losses of $19.8 million. Despite this, non-GAAP EPS of $0.52 beat estimates by $0.27.

While taking a cautious approach regarding the pace of recovery in industrial markets, management has reiterated its full-year guidance of sales to range between $1.40 billion and $1.55 billion, compared with consensus expectations of $1.46 billion.

Is NGVT Stock a Buy?

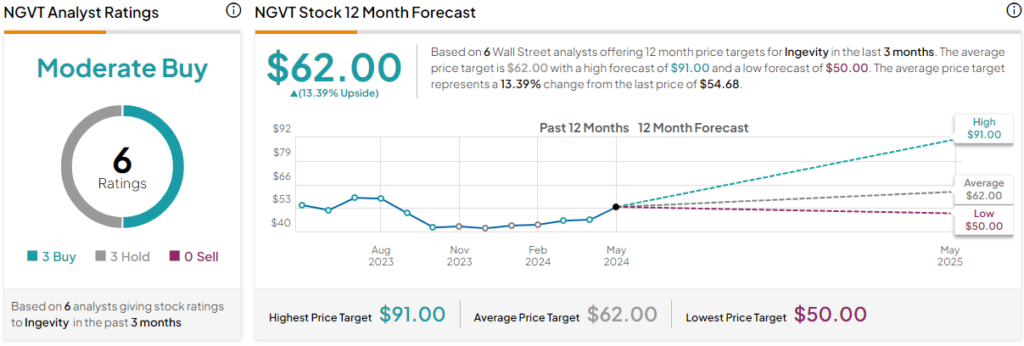

Analysts following the company have been cautiously optimistic about the stock. For instance, BMO Capital analyst John McNulty recently raised the price target from $50 to $55, though he kept a Market Perform rating on the shares. He notes the company’s strong start to the year but expects crude tall oil headwinds to last well into Q3, tempering growth.

Overall, Ingevity is a Moderate Buy based on the 12-month price targets and ratings of six Wall Street analysts over the past three months. The average price target for NGVT stock is $62.00, with a forecast range of $50-$91. The average price target represents a 13.39% upside from current levels.

The stock has been trending upward, climbing over 18% in the past 90 days. It currently trades in the middle of its 52-week price range of $36.66-$66.18 and shows positive price momentum, trading above the 20-day (52.07) and 50-day (49.27) moving averages.

NGVT Takeaway: A Solid Candidate for an ESG-Oriented Portfolio

Despite a few headwinds, Ingevity continues to exceed expectations with revenue and earnings growth. The stock has positive momentum, and its long-term prospects appear attractive, making it a solid candidate for an ESG-oriented portfolio.