Shares of EV maker Tesla (NASDAQ:TSLA) surged in after-hours trading after the company reported earnings for its first quarter of Fiscal Year 2024. Earnings per share came in at $0.45, which missed analysts’ consensus estimate of $0.49 per share.

Sales decreased by 8.5% year-over-year, with revenue hitting $21.31 billion. This missed analysts’ expectations of $22.256 billion. The lower revenue can be attributed to a lower average selling price and a decline in vehicle deliveries due to production disruptions in Berlin. The Model 3 update also had an impact on deliveries.

Furthermore, free cash flow fell substantially year-over-year, coming in at -$2.53 billion compared to $441 million in Q1 2023.

Is Tesla a Buy, Sell, or Hold?

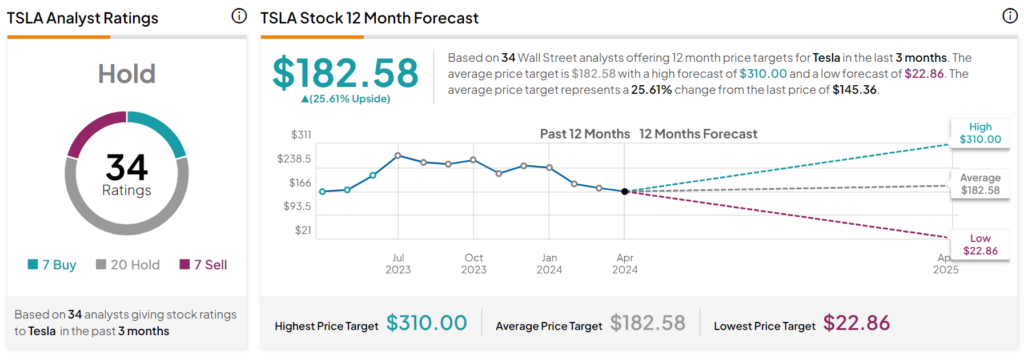

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on seven Buys, 20 Holds, and seven Sells assigned in the past three months, as indicated by the graphic below. After a 10.5% decline in its share price over the past year, the average TSLA price target of $182.58 per share implies 25.61% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.

Is It Wise to Allocate $1,000 Toward TSLA Stock Right Now?

Before you hurry to invest in TSLA, think about the following:

TipRanks’ team has built the Top Stocks Portfolio for investors, and Tesla is not included. Our portfolio highlights companies that have been hand-picked for their potential to deliver significant gains in the years ahead. See Top Stocks Model Portfolio >>