Walmart (NYSE:WMT) is by no means a fashionable name, but as the investing legend George Soros famously said, ‘good investing is boring.’ And when looking at the retail giant’s prospects, Tigress Financial’s Ivan Feinseth, a 5-star analyst rated in the top 2% of the Street’s stock pros, appears to believe that investing in Walmart is definitely a good idea right now.

“Walmart continues to benefit from operating, merchandising, and execution excellence and ongoing growth in e-commerce and advertising,” Feinseth said. “Increasing e-commerce and delivery capabilities combined with the ongoing expansion into high-margin services, including advertising and its ability to leverage AI and its massive customer transaction database, will drive increasing margin expansion and an ongoing acceleration in Business Performance trends.”

While you probably wouldn’t associate Walmart with tech innovation, that doesn’t mean it refrains from using the best modern tools at hand. Walmart consistently integrates cutting-edge tech, including generative AI, to enhance its operations. By strategically leveraging these advancements, Walmart aims to optimize its supply chain, thereby meeting customer demands more effectively through a smarter and interconnected omnichannel network. This approach is underpinned by a deep commitment to data-driven decision-making, intelligent software deployment, and automation. The outcome? Improved inventory accuracy and seamless flow across all sales channels.

Feinseth also likes the recent acquisition of TV manufacturer Vizio for $2.3 billion. That should provide a boost for Walmart Connect, its advertising platform which helps brands establish connections with consumers. Through Vizio’s SmartCast operating system, Walmart will leverage new ways to engage and cater to customers, offering innovative TV, in-home entertainment, and media experiences, thereby opening up fresh opportunities for advertisers to establish connections with their target audience. As part of its VIZIO Platform Plus business, which represents the bulk of its gross profit, Vizio already boasts more than 500 direct advertiser partnerships. “The combination is expected to further accelerate WMT’s media business in the U.S., Walmart Connect, bringing together VIZIO’s advertising solutions business with WMT’s reach and capabilities,” Feinseth further said.

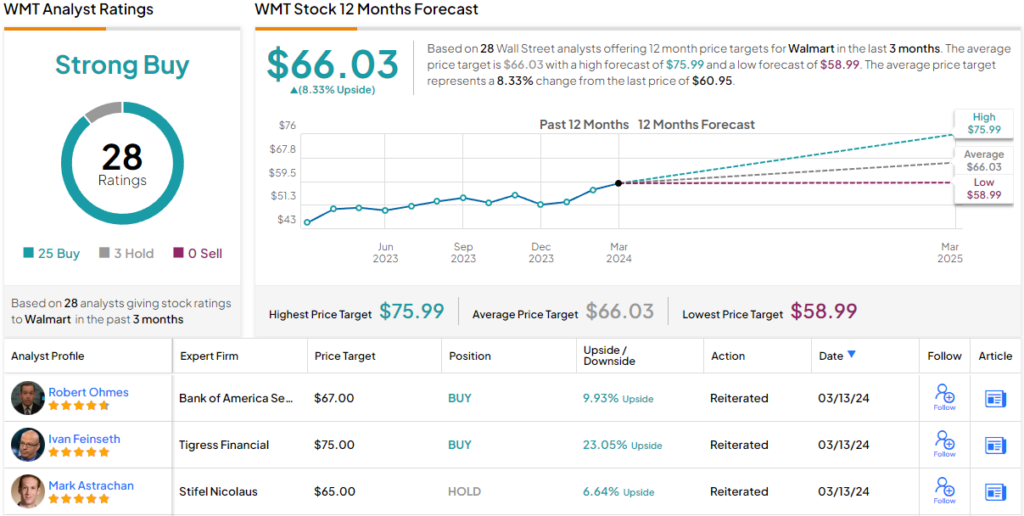

Accordingly, Feinseth rates WMT shares a Buy, while raising his price target from $65 to $75, suggesting the stock is set for 22% growth in the months ahead. (To watch Feinseth’s track record, click here)

Turning now to the rest of the Street, most of Feinseth’s colleagues are on the same page here. Based on a mix of 25 Buys vs. 3 Holds, the analyst consensus rates the stock a Strong Buy. Going by the $66.03 average price target, a year from now investors will be sitting on returns of ~8%. (See Walmart stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.