Shopify (NYSE:SHOP) (TSE:SHOP) plunged in trading after swinging to a surprise loss in the first quarter and a disappointing second-quarter outlook. The Canadian e-commerce provider swung to a loss of $0.21 per share in Q1, compared to earnings of $0.05 per share in the same period last year. Analysts were expecting the company to report earnings of $0.17 per share.

Revenues increased by 23% year-over-year to $1.9 billion in Q1, exceeding consensus estimates of $1.8 billion. SHOP’s Gross Merchandise Volume (GMV) increased by 23% year-over-year to $60.9 billion. The company defines GMV as the total dollar value of orders processed on Shopify, accounting for revenue-sharing arrangements, after deducting refunds, including shipping, handling, duty, and taxes.

SHOP’s Q2 Outlook

In Q2, SHOP expects its revenues to increase in “high-teens” percentage on a year-over-year basis, which is below analysts’ expectations of a growth of 19%. Shopify estimates its revenues to grow at a lower rate after adjusting for the impact between 300 and 400 basis points from the sale of its logistics business. Moreover, the company expects its gross margin to shrink by 50 basis points year-over-year as its operating expenses rise in low-to-mid-single digit percentage.

According to the TipRanks Stock Analysis tool, “Bulls Say, Bears Say,” analysts that are bearish on SHOP have predicted that rising operating expenses could affect the company’s margins over the near-term.

Is SHOP Stock a Buy?

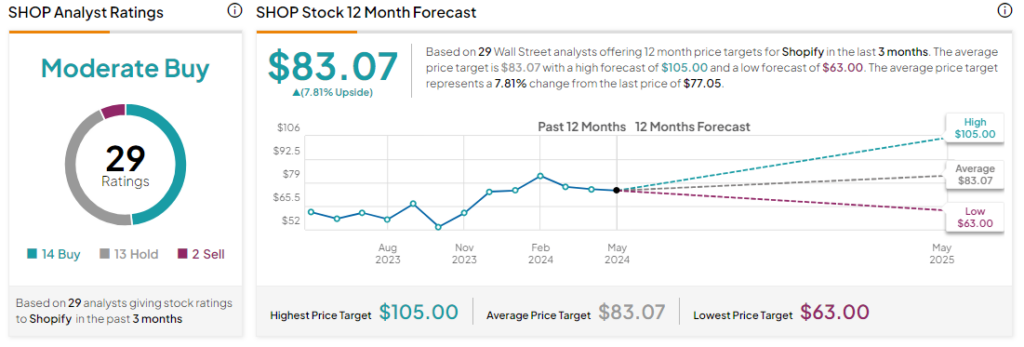

Analysts remain cautiously optimistic about SHOP stock, with a Moderate Buy consensus rating based on 14 Buys, 13 Holds, and two Sells. Over the past year, SHOP has jumped by more than 15%, and the average SHOP price target of $83.07 implies an upside potential of 7.8% from current levels. These analyst ratings are likely to change following Shopify’s first-quarter results today.