Meme stock mania has been making a comeback. Fueled by the return of ringleader Roaring Kitty – the Twitter persona of Keith Gill, the man who set off the craze in the first place and who seems to have as much of a grip on market fluctuations as the Fed – GameStop (NYSE:GME) was rallying hard earlier in the week before Wednesday’s big correcting session (down 30% as of this writing).

After an almost 3-year absence, Gill’s recent tweet showing a man leaning forward while holding what appeared to be a gaming console, was taken as a buying signal by the retail crowd, triggering 2021 shenanigans all over again.

Despite today’s downturn, GameStop’s stock is still up 93% for the week, a surge that clearly owes nothing to any fundamental improvements in the company’s business operations.

Of course, for investors feeling FOMO and wanting to get a piece of the action, the question is whether there’s any point in jumping in after such a huge surge.

While you might expect the answer to be a resolute no, investor Gytis Zizys notes that the videogame retailer’s cost-cutting measures “have been working quite well.”

“GME has improved its operations considerably in just one year,” Zizys goes on to say. “Going from deep in the hole to just about profitable, with the help of its cash pile, which is generating decent interest income, at least in the last quarter of 2023.”

But of course, that is completely besides the point and doesn’t merit the stock almost doubling in value.

Zizys’s take is that the company might have been worth a closer look now, if it wasn’t for the fact the stock’s wild trajectory has absolutely nothing to do with any financial metrics. So it is “not an investment you should be getting involved in if you are looking for a stable long-term investment,” Zizys sensibly says.

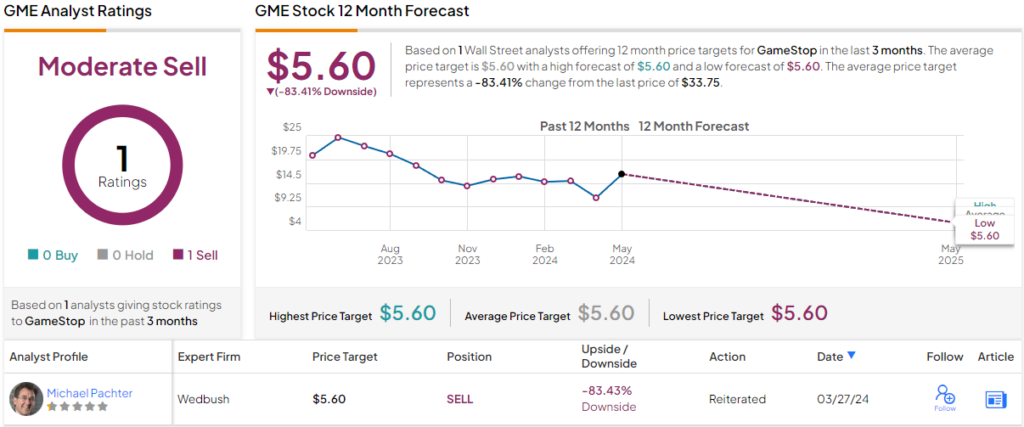

On Wall Street, analysts are showing little interest in GME. Currently, there is only one analyst review, which is a sell recommendation. The analyst has set a price target of $5.60, suggesting that the stock is overvalued by 83%. (See GME stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.