Shares of fintech innovator Block (SQ) have been in free fall for many months now, down more than 74% from its all-time highs. Undoubtedly, the company’s name change to Block from Square is a push for investors to focus on the firm’s forward-looking growth projects rather than its existing businesses, which face pressure from all sides. It’s not just the deteriorating macro-environment that’s weighing on Block; it’s the continued rise of disruptors in the fintech space.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Indeed, fintech was one of the first tech dominos to fall in this market. Block first peaked back in February 2021 before the rest of the Nasdaq plunged into a bear market. The fintech scene got quite crowded, and many investors were chasing far too many stocks to play the trend.

The rise in popularity of Buy Now Pay Later (BNPL) firms enticed Block to acquire Australian BNPL innovator Afterpay in a deal worth $29 billion. Looking back, the deal seemed ill-timed, given the recent bust across the broader basket of BNPL firms, many of which have exceeded the downside of your average fintech stock.

In prior pieces, I referred to Block’s Afterpay deal as a high-risk/high-reward move that could worsen the effect of the next recession. With a potential recession in the cards due to rate hikes, it seems like Block’s Afterpay deal is one that makes it that much harder for Block stock to form any sort of bottom.

Undoubtedly, the fintech scene got bubbly last year. Now that the bubble has likely mostly burst, I’m still not ready to get behind Block stock just yet. Rising competitive threats, a weaker economy, and investor reluctance to touch growth stocks with a 10-foot pole are just some of the reasons I remain bearish on SQ stock.

On TipRanks, SQ scores a 7 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to perform in-line with the broader market.

Apple Pulls the Curtain on Yet Another Fintech Innovation

Apple’s (AAPL) Tap to Pay feature, which clashes with Square’s point-of-sale (POS) business, was the first jab thrown by the world’s largest tech company. Undoubtedly, such an innovation from Apple could gradually render many POS terminals obsolete over time.

It’s not just Apple Tap to Pay that could be viewed as an existential threat. Apple is making a deeper dive into fintech at a time when many fintech players are on their knees.

Apple recently unveiled its own BNPL service called Apple Pay Later, which is conveniently tied to its already popular Apple Pay service. Undoubtedly, the BNPL service immediately has the edge over the broader basket of BNPL firms, given Apple’s ability to tap into its sizable installed base of users that are already on Apple Pay. It’s hard to match the strength of Apple’s network effects.

As Apple continues building out its fintech ecosystem, Block faces a challenging competitor entering its turf. Despite Apple’s fintech push, I do think Block is capable of improving its own ecosystem around Cash App.

It will be harder for Block to differentiate its offering, as Apple goes on the offensive. However, Jack Dorsey already has his sights set on the next big thing. Blockchain technologies and cryptocurrencies could represent the next frontier for fintech. At Block, there’s no shortage of blockchain projects, with TBD and Spiral.

Still, it has to be uncomfortable for Block shareholders knowing that Apple is just sitting on the sidelines, waiting for another firm to test out new market waters before it makes a move. At the end of the day, Apple is all about reinventing things and one-upping peers in existing markets.

Wall Street’s Take

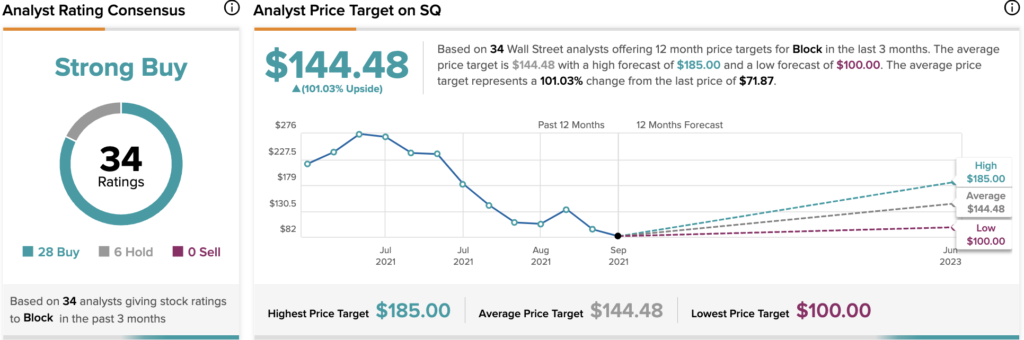

According to TipRanks’ analyst rating consensus, SQ stock comes in as a Strong Buy. Out of 34 analyst ratings, there are 28 Buy recommendations and six Hold recommendations.

The average Block price target is $144.48, implying an upside of 101.03%. Analyst price targets range from a low of $100 per share to a high of $185 per share.

The Bottom Line on Block Stock

Block stock could stand to be one of the losers from Apple’s move into the fintech world. Still, there’s no reason why Block and Apple cannot both thrive in the fintech market if Dorsey plays his cards right. Fortunately, I don’t think satisfied Cash App users will be in any rush to jump on over to Apple’s offering, especially those using non-Apple devices.

Furthermore, Cash App could continue to expand its userbase, as it becomes more bank-like with time.

As Block looks to keep rivals at bay, it faces a bleak economic environment, making it tough to draw a line in the sand amid the stock’s ongoing downfall. That’s likely why Wall Street remains so bullish.

Read full Disclosure