Risk and reward are the yin and yang of stock trading, the two essential yet opposing forces in every market success. And there are no stocks that better embody both sides – the risk factors and the reward potentials—than penny stocks.

Traditionally, these are shares sold for just pennies each; nowadays, they’re the stocks priced under $5 per share. At that low entry cost, even a small gain in absolute value will quickly turn into a high-percentage return—and gains of 400% or higher are not unheard of. Of course, the risk is real, too; not every penny stock is going to show these sorts of gains. Some of them are cheap for a reason, and not every reason is a good one.

So, how are investors supposed to lock in on compelling plays? That’s where the experts come in, namely the analysts at Oppenheimer. These pros bring experience and in-depth knowledge to the table.

Looking at two penny stocks with the Oppenheimer stamp of approval, the firm’s analysts believe both could rally over 400% in the next year. Running the tickers through TipRanks’ database, both have been cheered by the rest of the Street as well, as they boast a ‘Strong Buy’ analyst consensus.

Protara Therapeutics (TARA)

We’ll start with Protara Therapeutics, a clinical-stage biopharmaceutical company focusing on the development of transformative therapies for the treatment of cancer, as well as various rare diseases. Protara currently has a pipeline built around two investigational compounds and is shifting from early clinical work to a more advanced set of clinical trials.

The leading candidate, featured in multiple clinical trial research tracks, is TARA-002. This is a new cell therapy, derived from OK-432, a broad immunopotentiator; OK-432 already has approval in both Japan and Taiwan for treatment use in a range of oncologic indications, and in LMs, or lymphatic malformations. Protara’s development of the drug is being tested in the treatment of non-muscle invasive bladder cancer (NMIBC) and in LMs for patients in the US.

Protara recently reported that its research programs revolving around TARA-002 in the treatment of NMIBC showed positive data from the evaluable CIS patients in the ongoing clinical program. Six-month data from another trial, the Phase 2 ADVANCED-2 study, is expected for release during 2H24.

The company also has an ongoing study of TARA-002 in the treatment of LMs, with patient enrollment and dosing continuing to progress. This study, STARBORN-2, is a Phase 2 study of pediatric LMs patients, with a goal of 30 enrolled patients to receive four doses of TARA-002 set six weeks apart.

Finally, in April of this year, the company announced that it was in alignment with the FDA on the ‘registrational path forward’ for the IV Choline Chloride research track. This compound will be studied in patients dependent on parenteral nutrition (PN), who are currently or may become unable to independently synthesize choline from other nutrition sources.

All of this adds up to a diverse research program showing substantial promise. That, and the projected dollar-size of the therapeutic market, has sparked the interest of Oppenheimer analyst Leland Gershell.

“TARA reported impressive three-month complete response data from its ongoing studies of TARA-002… The clinical results further support 002’s potential to become an important product in the multi-$B US therapeutic market implied by this disease population and increase our enthusiasm ahead of initial six-month Phase 2 data, to come in 2H… With other players in high-risk NMIBC development garnering considerably higher market valuations (EV for Phase 3-stage CGON and Phase 2-stage ENGN are respectively ~$1.8B and ~$400M vs. TARA’s ~$10M)… we see [TARA] shares as compelling at current levels… We believe shares hold significant upside potential as pipeline progress is registered,” Gershell opined.

Gershell goes on to rate TARA stock as Outperform (i.e., Buy) and sets a price target of $30 on the shares, suggesting an impressive 934% upside over a one-year horizon. (To watch Gershell’s track record, click here)

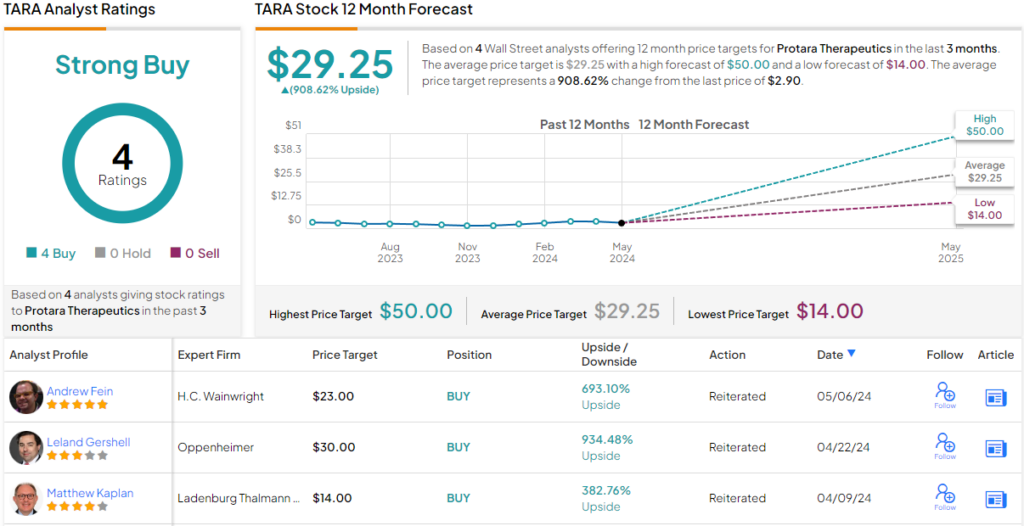

No one is arguing with that take on Wall Street. The stock’s Strong Buy consensus rating is based on Buys only – 4, in total. The stock is selling for $2.90, and its average price target, of $29.25, implies a one-year gain of ~909%. (See TARA stock forecast)

Opthea Ltd. (OPT)

The second penny stock we’ll look at here is Opthea. This Australian medical research company is focused on the treatment of various eye diseases, and has worked on diabetic macular edema, corneal neovascularization and transplantation, and dry eye disease. The company’s current work is targeting wet AMD, or wet age-related macular degeneration. This is a less common development of the dry AMD, and can occur at any stage of the more common condition’s development. Wet AMD typically causes faster vision loss than the dry variant, and occurs when abnormal blood vessel growth at the back of the eye damages the macula.

Following that track, Opthea has developed OPT-302, a novel therapeutic agent now dubbed sozinibercept. This agent acts as a VEGF-C/D ‘trap’ and is designed to be used in combination therapy with existing anti-VEGF-A agents, which constitute the current standard of care. Sozinibercept has shown promise in earlier studies and offers an opportunity to meet the significant unmet medical needs of patients with wet AMD—an important development, given that most patients exhibit a sub-optimal response to current treatments. Additionally, this drug candidate has demonstrated some promise in treating diabetic macular edema, or DME.

The most advanced clinical trial in the company’s pipeline focuses on the treatment of wet AMD. Opthea has two Phase 3 trials in progress, ShORe, which is testing the drug in combination with ranibizumab, and COAST, which is testing OPT-302 alongside aflibercept. The company announced in February that it had completed enrollment in the COAST trial, and that enrollment in the ShORe trial was expected to reach completion during calendar 2Q24. Top-line results from both trials are anticipated to be available in mid-2025.

5-star analyst Hartaj Singh, one of Oppenheimer’s biotech experts, has looked into the potential of Opthea’s sozinibercept and is impressed. He notes the early successes in safety profiling, and says of the company and its drug candidate, “We believe that OPT has many of the qualities we are desirous of in a small-cap biotech company: an execution-focused management team; validated science and technology; and compelling early/mid-stage clinical data… Sozinibercept has the potential to provide vision benefit on top of any anti-VEGFA agent with a well tolerated safety profile based on compelling Phase 2B results… Other emerging approaches and modalities in wAMD focus on better durability, with sozinibercept being the only agent aiming to provide a vision benefit…”

In-line with this view, Singh gives OPT shares an Outperform (i.e. Buy) rating while setting an $18 price target that indicates his confidence in a robust 447% one-year upside potential. (To watch Singh’s track record, click here)

Overall, Opthea has 3 positive analyst reviews on file, giving the shares a Strong Buy consensus rating. The stock is selling for $3.30 and has a $16 average price target, suggesting a ~385% gain for the year ahead. (See OPT stock forecast)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.