E-commerce and cloud computing giant Amazon (NASDAQ:AMZN) will release its Q1 2024 financial results on Tuesday, April 30. Amazon’s first-quarter financials will likely benefit from the ongoing strength in its cloud platform, Amazon Web Services (AWS). Moreover, the momentum of its digital ad business, efficiency savings from the regionalization of its fulfillment network, and a focus on lowering the overall cost structure will likely support its top and bottom lines. However, macro headwinds could remain a drag.

As AMZN is well-positioned to deliver solid quarterly financial numbers, let’s look into the Street’s consensus estimates for its upcoming earnings.

AMZN – Q1 Expectations

Wall Street expects Amazon to post revenue of $142.63 billion in Q1, up 12% from $127.36 billion in the prior-year quarter. The company’s competitive pricing strategy, broad product assortments, and fast delivery will likely support its e-commerce business and overall sales. Moreover, higher revenue from existing customers and a solid pipeline will likely boost its AWS segment and, in turn, its net sales.

Also, Amazon is expected to benefit from solid double-digit growth in the advertising business, driven by ongoing momentum in sponsored ads.

Higher revenues and benefits from cost control measures are expected to significantly boost AMZN’s bottom line in Q1. Analysts forecast Amazon to report earnings of $0.84 per share, up from $0.31 in the year-ago quarter.

Here’s What Website Traffic Shows

Amazon is a leading e-commerce player and operates Prime Video, a subscription-based, over-the-top video streaming service. Thus, it is important to examine the company’s website traffic trends.

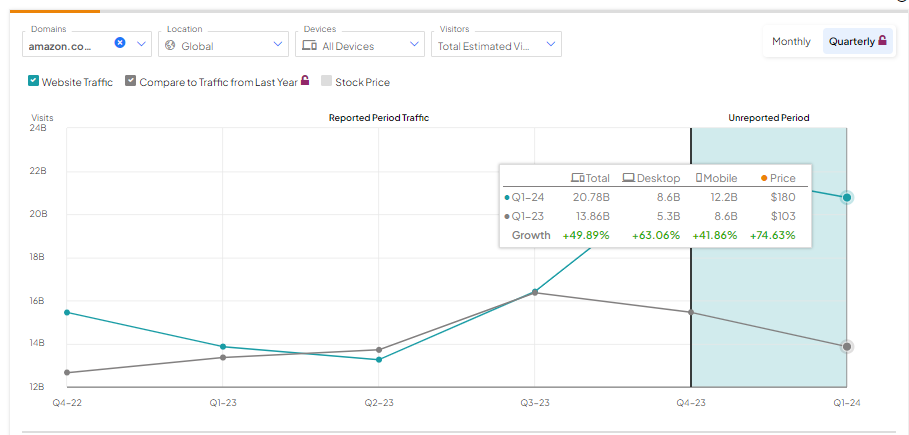

TipRanks’ website traffic screener reveals that AMZN’s traffic increased year-over-year in Q1. However, it decreased sequentially as macro headwinds continued to remain a drag. According to the tool, the number of visits to amazon.com and its other websites increased by 49.89% year-over-year in Q1. However, website traffic fell by about 6% sequentially.

Learn how Website Traffic can help you research your favorite stocks.

Is Amazon a Buy or Sell?

Wall Street is bullish about its prospects ahead of the Q1 print. 42 analysts cover AMZN stock, and all recommend buying it. The stock is up about 76% in one year.

Amazon stock sports a Strong Buy consensus rating. The analysts’ average AMZN stock price target of $213.74 implies 19% upside potential from current levels.

Insights from Options Trading Activity

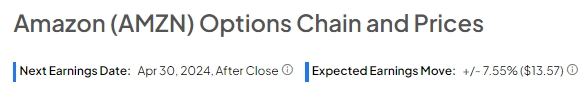

While analysts see decent upside potential in AMZN stock, options traders are pricing in a +/- 7.55% move on earnings, roughly in line with the previous quarter’s earnings-related move of 7.87%.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Bottom Line

Amazon is poised to deliver solid sales and earnings growth in the first quarter based on the ongoing momentum in its businesses and its efforts to cut costs. Wall Street analysts are also bullish about its prospects ahead of the earnings release. However, macro headwinds continue to pose challenges and could impact its financials to some extent.